Are you looking for Best Loan apps for Android? Do you want an instant cash loan for fulfilling your needs? Well, we are here with a comprehensive list of best loan apps for Android that’ll help you get instant loans from your Android device.

Best Loan apps for Android

Getting loans for personal use is a very tedious task. Traditional banks take a long-drawn time to process prosper personal loan reviews applications. Taking credit from Moneylenders, on the other hand, is quite ambiguous. Furthermore, they charge overwhelming interest rates. That’s where loan apps for Android come to rescue.

Certain Android apps allow for a smooth and hassle-free personal loan, that too within an hour. In this article, we are talking about best loan apps for Android 2019 using which you can avail instant loan without any paperwork or bank visit. Download these loan apps for Android and fulfill your dreams with just a tap.

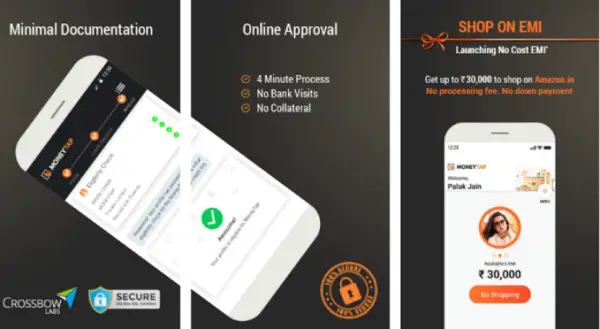

1] Instant Personal Loan – MoneyTap

MoneyTap is one of the best loan apps for Android. It provides instant loan via the paperless process. One of the USPs of MoneyTap is its no-usage-no-interest feature. As the name suggests, you are only bound to pay interest on the amount used. It makes MoneyTap more affordable and reliable.

Notably, this money lending company offers flexible interest rates. It is currently serving customers in 30+ cities in India including Delhi NCR, Mumbai, Bangalore, Hyderabad, and Chennai. That said, this app will grant you loans for a tenure ranging from 2 months to 36 months. It is a collateral-free personal loan. You can also consider this as a salary advance loan.

Download MoneyTap here.

2] Instant Personal Loan App – Indiabulls Dhani

As you might’ve already seen in adverts, Dhani by Indiabulls is popularly marketed as a “phone se loan” app. And it instantly dispenses the loan amount to your bank account.

With Dhani, you can avail personal loan, two wheeler loan, car loan, travel loan, marriage loan or medical loan instantly. The app provides instant Personal Loan ranging from Rs. One thousand to Rs. 15 Lakhs for a tenure of 3 months to 24 months. Furthermore, the Interest rates vary from 0.99 % to 2.83 % p.m. following the customer’s credit and risk profile.

Notably, the app has a provision of Zero Foreclosure Charges on loans below ₹ 20,000. Even the processing Fee is quite low at up to 5%. For those willing to buy a new motorcycle, Dhani will provide you 100% loan value for your two-wheeler and can also get the accessories covered under the loan. What’s more interesting is that you can get your loan amount in your bank even before visiting the bike dealer.

Download Indiabulls Dhani here.

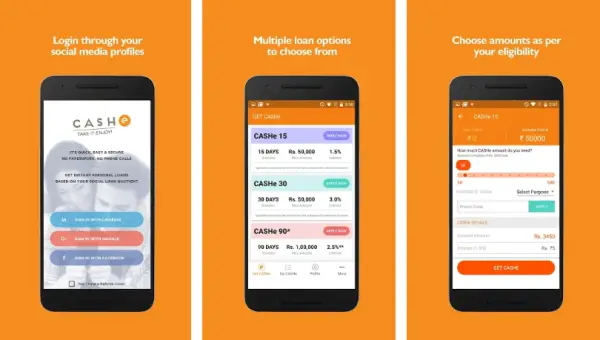

3] CASHe – Instant Personal Loans

CASHe is a digital lending company for young salaried millennials. It provides instant short-term personal loans to young professionals based on their social profile, merit and earning potential. The app uses its proprietary algorithm based machine learning platform to curate the same information.

One can get an instant loan from Rs 10,000 to Rs 2,00,000 for credit within 10 minutes, subordinate to proper documentation. To be specific, the app provides loans ranging from:

- Rs.5,000 – 50,000 for 15 & 30 days

- Rs. 19,000 – 1,00,000 for 90 days

- and 25,000 – 2,00,000 for 180 days.

Note that CASHe currently provides instant personal loans to salaried professionals with a minimum salary of Rs. 15,000.

Documents required for availing loans include a self Signed PAN Card, Aadhar Card, latest Salary Slip, updated Salary Bank Account Statement, any Address Proof (Current and Permanent), a selfie and a company ID.

Download CASHe here.

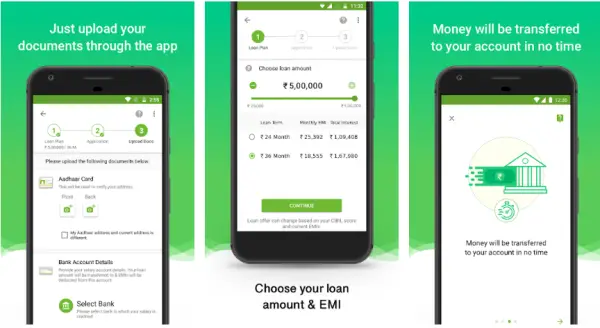

4] Money View Loans – Personal Loan

The Money View Loans is indeed one of the best loan apps for Android, allowing to get a personal loan up to Rs 5 lakh in just a few hours. This app gives you the freedom to do more with your life. Whether you want to furnish your home, cover wedding customs, drive a party or take a break for a family vacation, you can get easy personal loans with Money View loans app.

That said, Money View Loans is indeed one of the fastest & most accessible ways to get a collateral-free personal loan. It uses proprietary credit models to use financial SMS data (sent by banks and billers) to give you the best real-time loan offer. Compared to the regular credit scores, this process leads to a better assessment of your profile to avail the best possible offer. Also, having a credit history isn’t mandatory at all to avail a personal loan through Money View Loans.

To apply for a loan, you need to follow some necessary steps.

- Choose the loan amount and loan tenure.

- Upload your documents & complete your loan application.

- Check your eligibility & verify the documents.

- Review and submit the loan agreement.

Download Money View here.

5] PaySense – Instant Personal Loan app

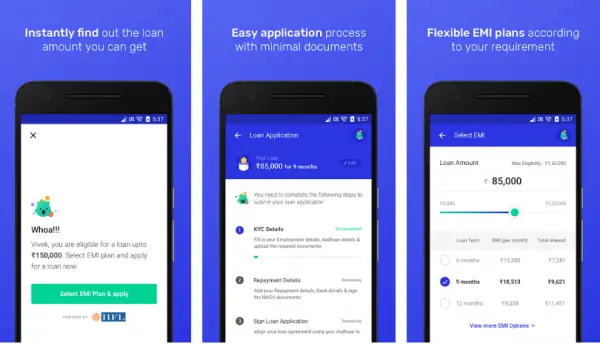

PaySense has partnered with IIFL and Fullerton for disbursing personal loans in India. The app offers personal loans for medical emergencies, marriage obligations, buying two-wheeler, paying school and college dues, buying new electronics, paying credit card bills, buying jewellery, investing in home decor, etc.

For starters, PaySense offers Instant Personal loans ranging from Rs. 5000 to 2 Lakhs on affordable EMI’s for salaried people. The tenure extended scales from 3 Months to 24 Months, and you can get loans within 3-5days. A bit slow to be honest but offers reliable service.

The app UI is very clean and intuitive, making it one of the best Loan Apps for Android. The Interest rates start at 16.8% annum. Furthermore, it depends on customers risk profile and loan tenure.

Here is a simple example — a loan of Rs. 10,000 for a tenure of 6 months, your EMI will Rs. 1809. Thus, the total interest you will pay is Rs. 857.

Download PaySense here.

So these were five of the best loan apps for Android 2019. Let us know what’s your pick amongst these. If you have used any of these or other Loan App, do share your experience with the name of the app.